Balancing Act

Welcome to the July 2022 edition of our Quarterly Investment Report.

This report brings you key investment insights from our research partners and independent advisory board.

Summary of our latest insights

- Global equities and bonds have fallen more than -10% calendar year-to-date, the first time both indices have fallen over -10% in the same six-month period.

- Restraining inflation through monetary policy (higher rates) will come at an economic cost, that will ultimately impact company earnings.

- We believe the uncomfortable adjustments to prices has likely factored in some of the expected slowdown to company earnings, but not all scenarios.

- An easing of monetary policy settings could reverse these expectations, providing a sugar hit to equities.

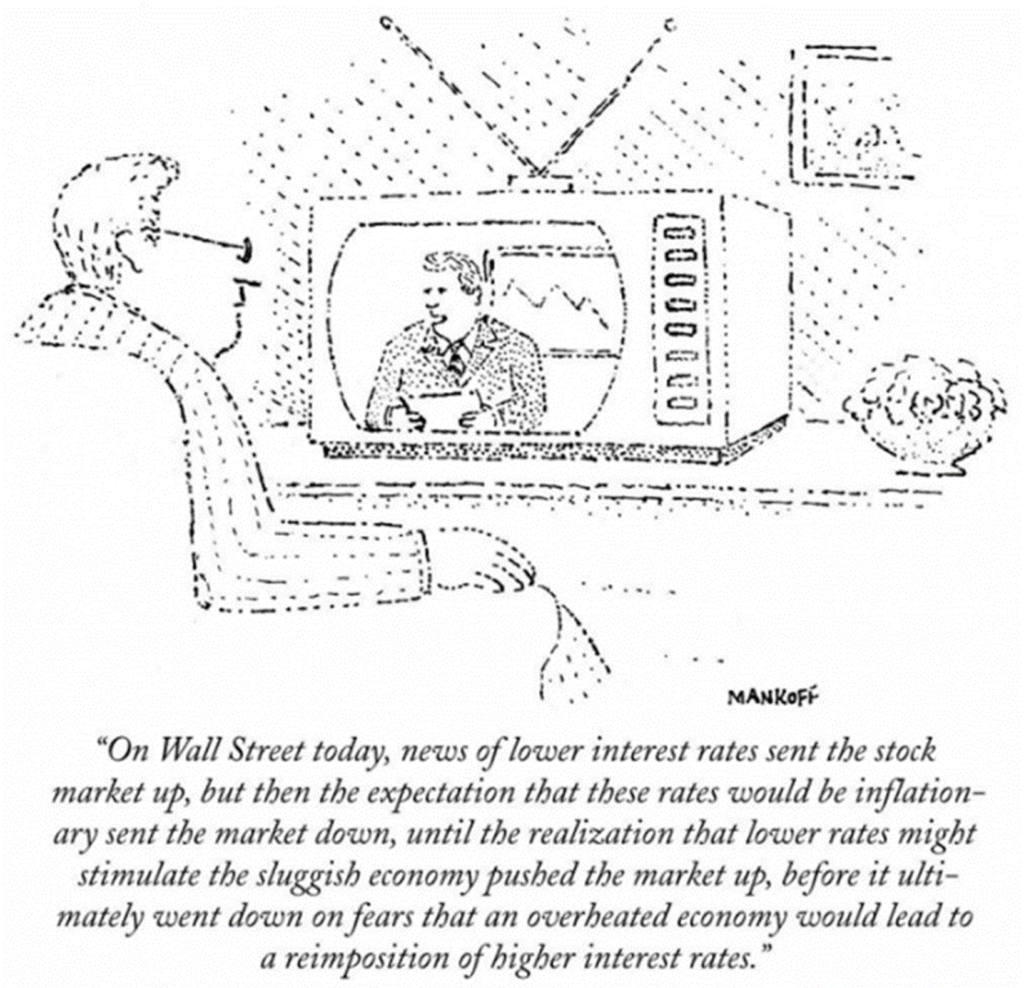

- Markets move in cycles, and the outlook, although challenging, is not permanent – reference the cartoon below from the 1970s. Dealing with uncertainty is part of investing and an ample reason why fear and greed habitually exaggerate market cycles.

- We are approaching a turning point for asset allocation decisions as fixed interest becomes more attractive. As such, the Advisory Board have upgraded their view on fixed interest to neutral, closing a three-year underweight position.

- The Advisory Board believe investors should be disciplined in keeping portfolios on a level footing, maintaining a balanced allocation between growth assets (equities) if the outlook is better than expected, whilst building up defensive assets (fixed interest) if the outlook is worse than expected.

More detail on our views and latest positioning can be found here.

This message is for the exclusive use of the intended recipient(s) and may contain confidential, privileged and non-disclosable information. If you are not the intended recipient, please contact the sender by reply email immediately and destroy any and all copies of the message. Please consider the environment before printing this email. Please click unsubscribe if you do not wish to receive future communications from Mackay Private.

General Advice Warning: The comments in this email do not take account of your objectives, financial situation or needs. Before acting on any general advice, you should consider if it is appropriate for you