Market Update – March 2024

Reporting Season

Increased economic optimism and robust corporate earnings have propelled stock markets to new heights. Yet, this rapid growth has left some investors apprehensive about potential overvaluation, while others fear missing out on gains.

Global Reporting Highlights

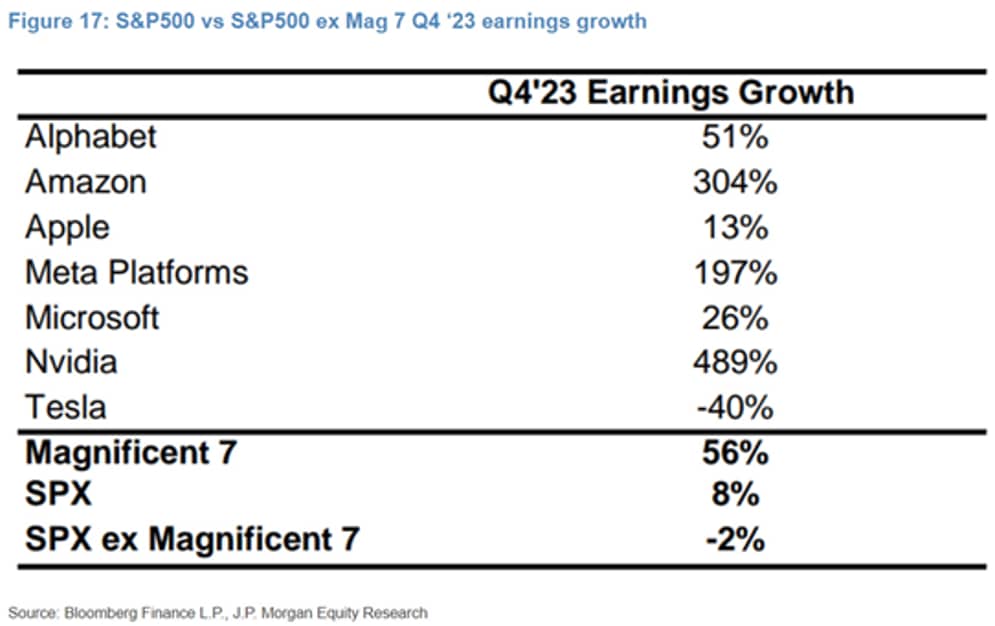

The remarkable rally in global equities, especially U.S. mega-caps, is underpinned by significant earnings growth, notably the Magnificent 7, which reported a +56% earnings increase in Q4 2023.

Investors globally face a difficult choice: invest in high-priced assets with strong earnings growth or opt for more affordable options with stagnant earnings.

Despite rising interest rates, there are signs that U.S. consumer spending is expected to stay robust, as evidenced by Delta Airlines news that nine of their top ten sales days in the airline’s history occurred in the first quarter of 2024.

ASX Reporting Highlights

ASX companies have prioritised cost management amid softening demand and inflationary pressures. ASX200 firms anticipate a -5% earnings decline in FY24, followed by a projected recovery of +4% annual growth in FY25 and FY26.

Despite the downturn, the ASX200 index has reached new highs, buoyed by sectors showing resilience and recovery potential. Notably, Banks have shown remarkable resilience with low impairments and prudent cost management.

Sectors like REITs (SCG, CHC) and healthcare (CSL, RHC) are beginning to recover from pandemic-related challenges. Discount retailers such as Kmart and Target (WES) are thriving as consumers seek more affordable options. Resources were hardest hit by falling commodity prices, particularly iron ore (RIO, BHP) and lithium.

Outlook & Opportunities

The solid earnings growth underpinning current high equity valuations also carries the risk of disappointment (priced for perfection) amidst persistent inflation and political uncertainty, highlighting the need for diversification.

There are still opportunities for investors, particularly in the small-mid cap sector globally and healthcare and resource sectors locally. These sectors are trading at compelling valuations and should benefit from future policy easing.

General Advice Warning: Any comments in this communication do not consider your objectives, financial situation or needs. Before acting on any general advice, consider whether it is appropriate for you.