ASX Reporting Season

Macroeconomic events overshadowed the recent ASX reporting season.

Fundamentals have taken a back seat whilst central bankers drive investor sentiment.

Over a 6-week period in June and July, global equities rallied +14% on speculation the FED would slow down their rate hikes; however, this was not the case (yet), and global equities swiftly retreated -6% over the last few weeks.

Just yesterday, the ASX200 gained +1.8% post a news conference from the RBA Governor, which seemed to portray a reduction in future rate hikes from +0.50% to +0.25%.

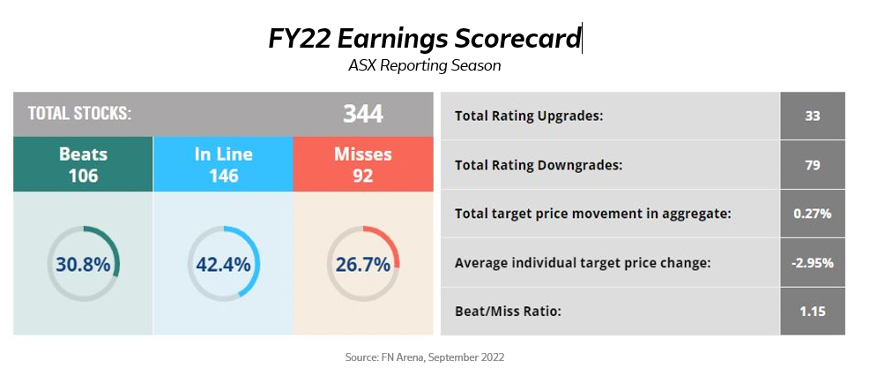

Nevertheless, long-term returns are driven by fundamentals, and notably, the recent ASX results and the outlook for FY23 were better-than-expected or, as one analyst said, “less bad than feared”.

Generally, results in beaten-up sectors were not as bad as everyone expected, and equally, results in favoured sectors were not as good as everyone expected.

- 80% of Technology companies delivered earnings that were better than expected, whilst 60% of these companies upgraded their future outlook

- Only 17% of companies within the Materials sector upgraded their future outlook to earnings after 61% of them delivered earnings that were better than expected

Rising input costs have weighed on the outlook, with roughly 2/3 of companies seeing revised earnings from analysts due to expected profit margin pressures. Earnings growth across the ASX200 is now expected to be -1.6% for FY23.

The central banker mindset of ‘some pain’ now is better than ‘far greater pain later’ supports a vigilant approach over the short-term but equal awareness of long-term opportunities.

We have topped-up some well-known quality names for clients that have been underweight.

From an asset allocation perspective, we continue to prefer liquidity and flexibility through a higher-than-normal allocation to Cash.

This update was provided by Mackay Private Pty Ltd ABN 32 636 659 580, a Corporate Authorised Representative of Mackay Private Partners Pty Ltd AFSL No.534073. This email message is for the exclusive use of the intended recipient(s) and may contain confidential, privileged and non-disclosable information. If you are not the intended recipient, please contact the sender by reply email immediately and destroy any and all copies of the message. Please consider the environment before printing this email. Please click unsubscribe if you do not wish to receive future communications from Mackay Private.

General Advice Warning: The comments in this email do not take account of your objectives, financial situation or needs. Before acting on any general advice, you should consider if it is appropriate for you.