Proposed Tax Reform

Below is a summary of today’s announcement regarding the proposed doubling of taxes on Superannuation balances above $3 million.

The proposal may have variations if legislated after the next federal election. We will address any relevant impacts with clients once (if) legislated.

Summary

- The ALP government has announced a policy to double tax on earnings of Superannuation member balances over $3 million from 15% to 30% from 1st July 2025.

- The 30% tax is applied on earnings made from the excess balance above $3 million, not the entire member balance.

- Member balances under $3 million retrain concessional tax rates of 15% whilst in the accumulation phase and 0% during the pension phase to the current transfer balance cap limit of $1.7 million (indexed to CPI).

- Initial communications suggest the $3 million concessional tax limit will not be indexed. We find this unusual given the pension transfer balance cap is indexed to CPI, creating problems when the two eventually overlap.

- For some, the proposed 30% tax rate is still more attractive than the highest marginal tax rate of 45%, supporting the use of Superannuation as a structure for balances over $3 million.

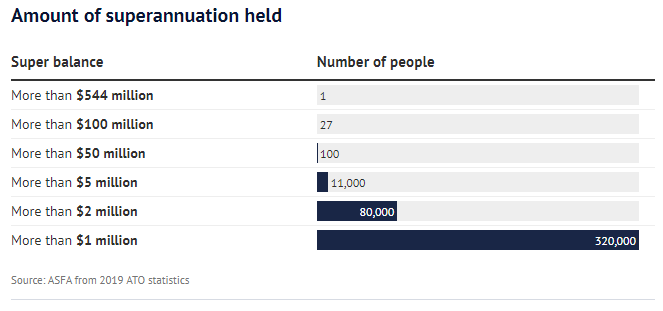

- The ALP will take the populist policy into the next federal election (2025), initially impacting only 80,000 people (0.5% of superannuation members) while raising $2 billion in tax revenue in its first year.

General Advice Warning: Any comments made in this communication do not consider your objectives, financial situation or needs. Before acting on any general advice, consider whether it is appropriate for you.