Quarterly Investment Report – Oct 2023

Defying Trends

Our October report examines the key themes, risks and opportunities for the remainder of 2023 and beyond.

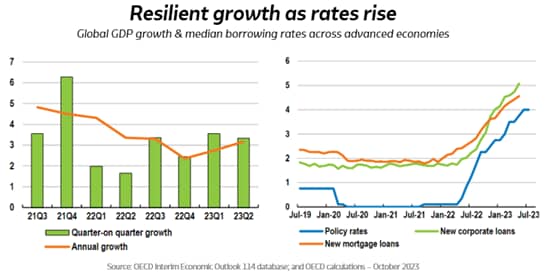

Overall, the economy continues to defy expectations. Resilient growth reflects longer-than-expected policy lags, supported by an uneven interest rate burden that will keep rates higher for longer.

We are locking in higher yields by increasing our overweight position to Fixed Interest.

Summary of latest insights

- Global Economic Resilience – Despite rising interest rates, the global economy has shown surprising resilience, with accelerated growth in the first half of 2023 and upward revisions to the second half, even after a 4% increase in policy rates from 2022 lows.

- Inflation is Moderating – Uneven debt burdens and a favourable job market have shielded parts of the economy from the impact of higher interest rates. They have benefited parts of the economy with increased income and wages.

- Recession Concerns Remain – Robust growth may prevent inflation from reaching the target level, forcing central bankers to tighten financial conditions excessively. The consensus probability of a global recession stands at around 50%.

- Higher for Longer – We expect interest rates to stay elevated for an extended period to control inflation. Historical patterns reveal that inflation trends are rarely linear. We foresee a minimum of 12 more months for inflation to return to the target range.

- Adding to Private Credit – Higher for longer rates favour Private Credit strategies. We are increasing our overweight exposure to Fixed Interest through Private Credit strategies offering >8% p.a. yields on high-quality loans (investment grade) and lower capital volatility than public markets.

General Advice Warning: Any comments made in this communication do not consider your objectives, financial situation or needs. Before acting on any general advice, consider whether it is appropriate for you.