High-frequency data

We wanted to share some interesting trends leading into the Easter long weekend.

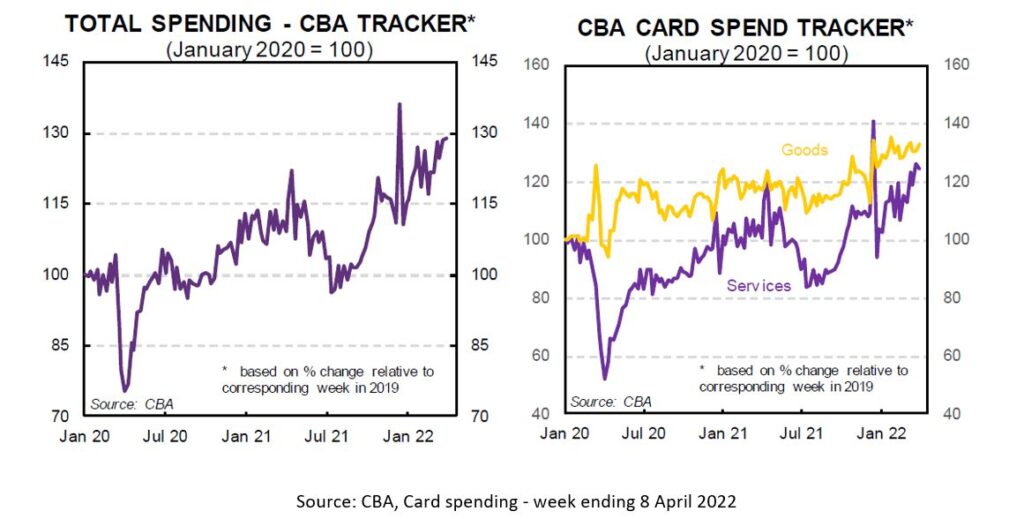

Recent CBA card transaction data shows a significant lift in spending, mainly services, now 20% above pre-covid levels (restaurants, hotels, travel).

The recent spending habits of consumers do not reflect a broader concern about inflation and future interest rate hikes. However, this is a medium-term risk, and one our Advisory Board will discuss later this month.

The continued strength of the Australian economy corresponds with relaxed covid restrictions, high household savings, wages growth and low unemployment, an ideal backdrop for the RBA to begin hiking rates.

Why is this data important? Consumer spending represents roughly 60% of Australian GDP. As Australia’s largest bank, the CBA has visibility over more than 40% of card transactions nationally, providing a good proxy for economic conditions.

General Advice Warning: Any comments made in this video do not take into account your objectives, financial situation or needs. Before acting on any general advice, you should consider if it is appropriate for you.