Patient but attentive

The past few weeks have been challenging for investors as central banks embarked on increasing policy rates in the face of persistent inflation.

The MSCI Equity World Index has now declined more than 16.6% year to date (YTD), whilst the Global Aggregate Bond Index has declined more than 10.5% YTD.

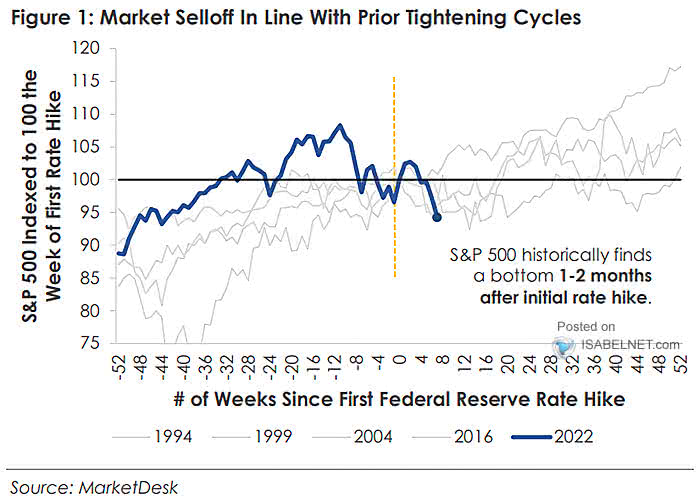

History suggests we may be closer to the end of surging bond yields and equity market weakness. The S&P500 has historically found a bottom 1-2 months after the first rate hike (below chart).

We remain patient and attentive – intraday volatility will remain elevated as the market digests important data points over the coming months. Notwithstanding further geopolitical risks, the direction of markets will hinge on economic data, not fundamentals.

This uncertain period supports a higher weighting to Cash and neutral allocation to Equities.

As always, appropriate diversification and an allocation to Alternative assets will prove essential for superior risk-adjusted returns.

General Advice Warning: The comments do not take account of your objectives, financial situation or needs. Before acting on any general advice, you should consider if it is appropriate for you.