Market Volatility: A Time to Stay Focused

Given recent market movements, we want to provide some context on what’s happening and answer some questions that you may have.

While headlines may appear unsettling, it’s essential to remain focused on broader market trends and opportunities.

What is causing the recent market volatility?

Lately, share markets in the US and Australia have dropped about 10% from recent highs. The main driver? Escalating trade tensions and uncertainty about their impact on global growth. The back-and-forth on tariffs has created confusion, making investors nervous.

That said, while the risk of prolonged trade disputes has increased, a full-scale trade war still seems unlikely. As we’ve said before, markets dislike uncertainty, and while politicians can be unpredictable, they are also adaptable. For now, patience is key as we wait for more clarity.

Should I be concerned about a recession?

While global economic growth has slowed, the bigger picture doesn’t suggest a recession is imminent. Trade uncertainty has affected consumer sentiment, but corporate balance sheets remain strong, earnings are holding up, and central banks stand ready to provide policy support if needed.

A key warning sign of economic trouble – credit markets – are not showing major stress, reinforcing the view that the economy remains on solid footing.

What does this mean for my portfolio?

Market drops of 10% or more are a normal part of long-term investing. They have occurred about once a year for the past fifty years, each time driven by different factors. Your portfolio is designed to manage these ups and downs while staying on track for sustainable growth and income.

Over the past month, the average balanced portfolio has declined about 3%, significantly less than the broader market’s 10% drop. On the bright side, equity markets outside the US and Australia have performed better, alongside Bonds and Alternatives, helping diversified portfolios remain more resilient.

Are there opportunities in the current market?

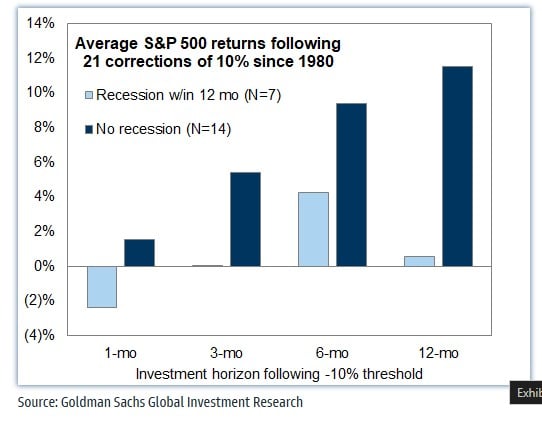

Yes. Historically, sharp market declines like this one have created attractive entry points, provided a major recession is not looming—see the chart below.

We are taking advantage of recent volatility by selectively increasing exposure to global equities and rebalancing Australian equity holdings following the ASX reporting season. This involves adding to high-quality companies now trading at more attractive valuations. For more details on the ASX reporting season, check out the link below.

Short-term volatility is a natural part of investing, but history shows that markets recover over time. While the timing of a rebound is uncertain, what we can control is our approach. The most effective strategy is disciplined investing – thoughtful position sizing and gradually increasing exposure to quality assets at lower prices, rather than trying to predict market bottoms.

As the old Wall Street saying goes: “The stock market is the only market where things go on sale, and all the customers run out of the store.”

Whether markets dip further or start recovering, the real power of investing comes from time in the market and the compounding of returns. This is why patience, and a long-term perspective are so important.

General Advice Warning: Any comments in this communication do not consider your objectives, financial situation or needs. Before acting on any general advice, consider whether it is appropriate for you.