Market Volatility

The recent volatility in the stock market has become a major talking point. After six months of unusual calm, the past week has seen significant fluctuations.

It’s important to put these movements into perspective.

Historical perspective

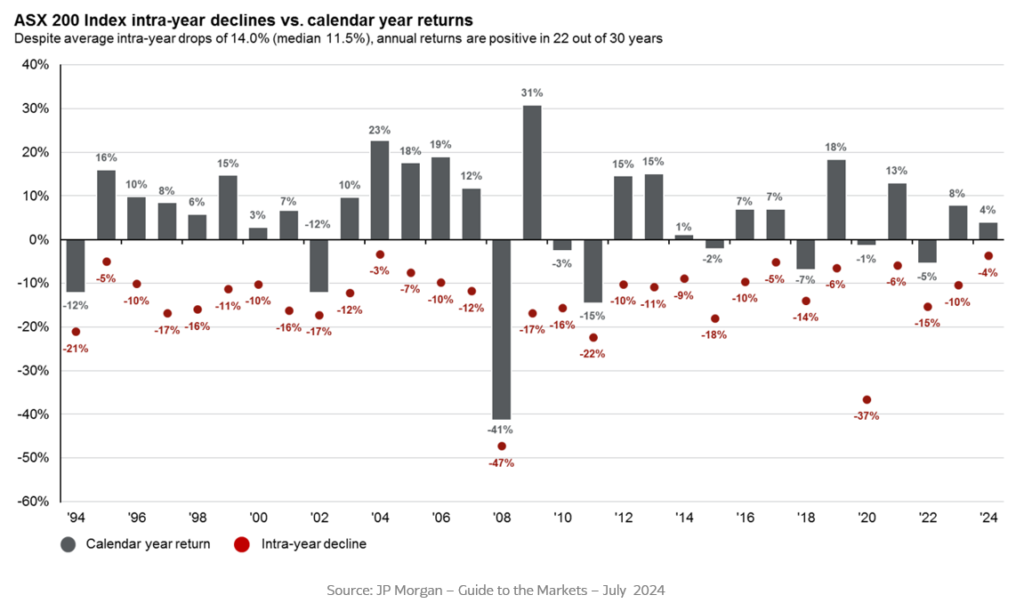

Historically, both the Australian and U.S. stock markets experience annual corrections, often with an average intra-year drawdown exceeding 10%. These corrections are triggered by various factors. The current declines of 8% in the U.S. and 5% in Australia are relatively modest by comparison. Additionally, markets tend to recover and close the year positively about 70% of the time following such corrections.

Factors driving recent volatility

Several factors have driven the recent spike in volatility, significantly shifting market sentiment. Initially, weaker-than-expected U.S. employment data sparked fears of a recession. This concern was then compounded by an unexpected rate hike from the Bank of Japan. The rate hike led to the unwinding of leveraged carry trade positions, which accelerated weakness across overbought segments of the share market.

However, there are indications that policymakers may implement “insurance cuts” in 2024 to mitigate the increasing risk of a recession, a move that has historically stabilised markets.

Context & Positioning

Despite recent turbulence, the S&P 500 and ASX200 remain up nearly 10% and 4%, respectively, for 2024. As discussed in our recent quarterly report, we view this period of consolidation as a normal part of the cycle, especially after a strong start to the year.

While stock market volatility can be unsettling, it’s a natural part of investing. It only becomes problematic if it disrupts an investor’s strategy (leverage) or provokes emotional reactions. For most investors, market pullbacks offer opportunities to acquire quality assets at discounted prices.

We are using the recent volatility to reinvest cash distributions into global equities and are prepared to increase our positions if major benchmarks enter correction territory, defined as a decline of more than 10%.

General Advice Warning: Any comments in this communication do not consider your objectives, financial situation or needs. Before acting on any general advice, consider whether it is appropriate for you.