Cost Control & Pricing Power

Understandably, the war in Ukraine has overshadowed a strong ASX Report Period.

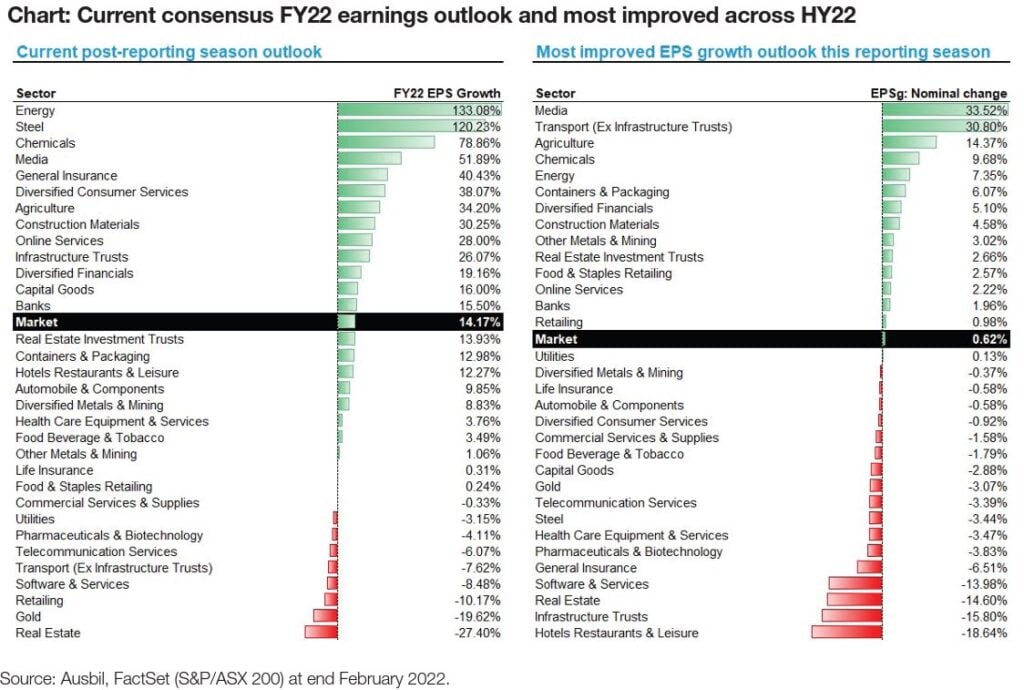

Analysts displayed growing optimism as Australian businesses emerged from the omicron wave better than feared. This optimism translated into upgraded FY22 earnings from 13.6% to 14.2%, led by materials and energy sectors, the beneficiaries of global inflation and geopolitical risks.

Increased profits boosted business cash reserves in the December half, while strong revenues cushioned the blow dealt by rising costs as inflation challenges margins.

To date, rising costs have been managed well, with many businesses maintaining margins by passing through higher inflation-related costs. BHP acknowledged this in their update “in spite of the inflationary environment that we find ourselves in, we are doing a pretty good job of keeping a lid on costs”.

Many retailers (HVN, JBH, WES) have increased inventory levels in the face of supply constraints, negatively impacting short-term cashflow – lower dividends. Cost control and pricing power will be an essential driver of earnings whilst global inflation remains elevated, and household savings diminish. Companies with pricing power (ALL, CSL, TCL) or a low-cost of production (BHP) should navigate this period relatively well.

Despite the overall upgrade to ASX200 FY22 earnings, we are aware of how quickly expectations can change due to persistent headwinds (inflation, war, covid). We remain diligent in rebalancing portfolios around price dislocations caused by heightened volatility.

General Advice Warning: The comments do not take account of your objectives, financial situation or needs. Before acting on any general advice, you should consider if it is appropriate for you.