Delta, Dividends and Small Caps feature

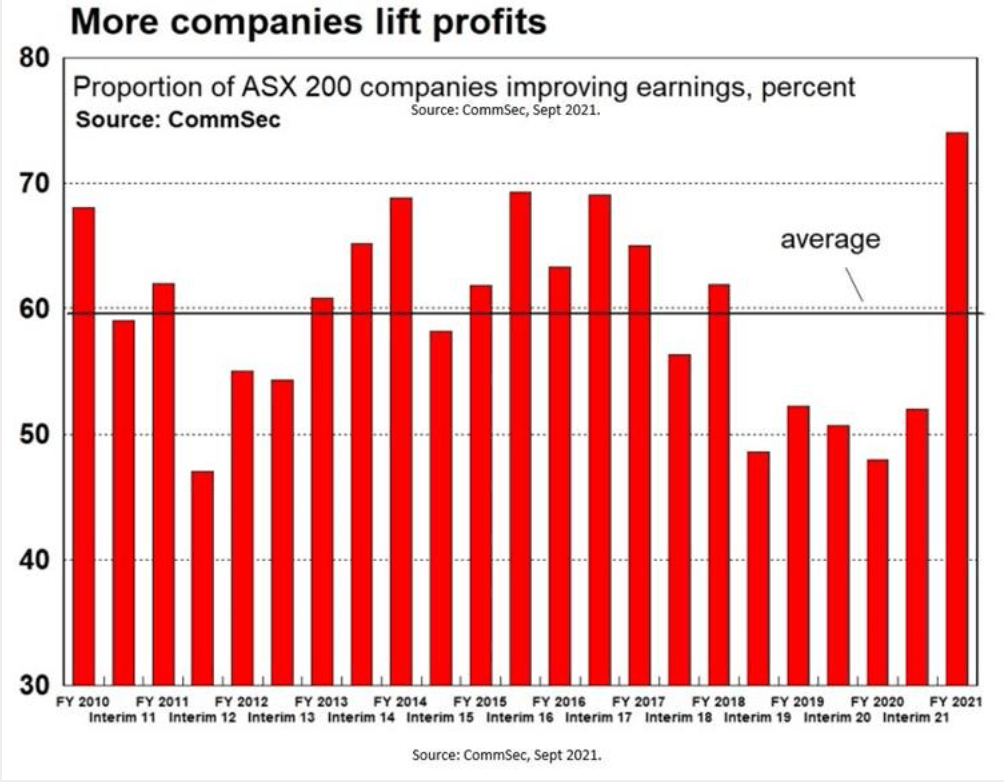

This year’s reporting season revealed a strong rebound to earnings and dividends in the face of a delta variant that has temporarily delayed but not derailed the outlook.

Summary

- ASX200 earnings grew +26% in FY21 – broad-based recovery to earnings, driven by Resources and Banks. Earnings expectations for FY22 remain robust at +20%.

- Investors are looking through the Delta variant – despite having more downgrades, investors rotated to reopening plays (COVID losers e.g. RHC & TCL).

- Reopening the economy will remove a tailwind for COVID beneficiaries – online retail & auto-related sectors.

- Dividends have recovered faster than expected – supported by sound balance sheets (Cash) and improving profitability.

- Small Caps were a positive surprise for June half-year earnings – ex-ASX100 companies had more results beating earnings estimates than ASX100 companies.

- Growth leadership is shifting to offshore earners – offshore earners are expected to grow earnings at a higher rate over FY22-23 (e.g. AMC & ALL).

General Advice Warning: The comments do not take account of your objectives, financial situation or needs. Before acting on any general advice, you should consider if it is appropriate for you.