Front Loading

Last Tuesday, the RBA lifted its cash rate by +0.50% to 0.85%, the biggest rate hike in 22 years and the first back-to-back rate hike since May 2010.

It’s clear that ultra-accommodative policy settings (low rates) are no longer needed as consumer spending and record low unemployment lead to price increases (inflation) across many goods and services.

The RBA, like their global peers, face the difficult task of slowing down the spending (demand) until production (supply) catches up, and inflation pressures moderate back to target ranges of 2-3% p.a.

CBA economists expect the RBA to ‘front load’ rate hikes in the coming months: +0.50% in July, and then monthly +0.25% hikes until November, taking the cash rate to 2.10% by year-end.

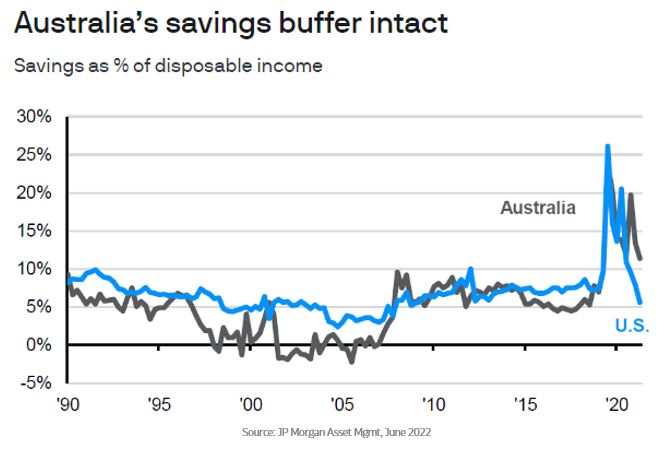

Arguably, the RBA has moved aggressively because households, on average, have the excess capacity to cushion initial rate hikes.

It’s essential to highlight that Australian households have accumulated ~$280 billion in additional savings since the start of the pandemic.

Higher rates will naturally lead to some increases in bad debts, although our initial view is that this is unlikely to be systemic, with the percentage of new home loans with an LVR >90% sitting around 7%.

Front-loading rate hikes will also provide further scope to cut rates should recession fears grow. Remarkably, the market is already pricing in a rate cut by 2H-2023.

Our Advisory Board will meet next month to discuss recent developments, including opportunities and risks to our private client and MP Online portfolios.

General Advice Warning: Any comments made in this video do not take into account your objectives, financial situation or needs. Before acting on any general advice, you should consider if it is appropriate for you.