Ukraine and Russia Crisis

Below are our early observations regarding the current crisis in Ukraine.

We are monitoring the situation closely and hearing from a range of industry experts to understand the impact as it evolves.

Ultimately, short-term outcomes are difficult to predict. This reinforces the benefits of having a balanced, long-term, valuation driven approach to portfolio management.

Summary

- The developing events in Ukraine are concerning on every level, leaving a wide range of potential outcomes and scenarios.

- Newsflow is driving short-term market performance, understandably testing investor psychology.

- We don’t believe any immediate actions are needed to protect our diversfied portfolios from the risks tied to Ukraine.

- Overall, our portfolios have a negligible exposure to Eastern Europe whilst remaining highly diversfied and balanced across defensive and growth asset classes, investment styles, managers and regions.

- We are using the current volatility in markets to assess growth asset opportunities, looking through the noise by letting valuations control capital allocation decisions.

- This is a period where seperating emotion from investment decisions is crucial. Trying to out-smart the market can be a dangerous habit as pullbacks are hard to predict, and strong returns often follow the worst returns.

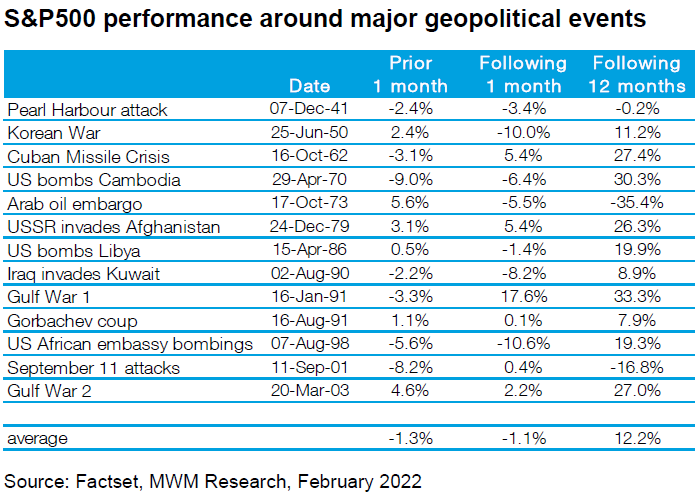

- We acknowledge every conflict is different; however, history suggests equity market weakness is short-lived, as investors adjust to the initial shock of the event, before focusing on longger-term fundamentals (below chart).

- As we look deeper into the year, we expect economic growth and corporate earnings to be the most important determinants of market direction as policy settings normalise.

General Advice Warning: The comments do not take account of your objectives, financial situation or needs. Before acting on any general advice, you should consider if it is appropriate for you.